Order profit? Would you like to receive an honest profit from savings and at the same time not "freeze" money for a long time - your order has been fulfilled!

You also can visit one of our branches in Kyiv, Dnipro, or Odesa and open a deposit there, but at a rate without considering additional bonuses.

If you have the slightest question or doubt – we are available 24/7

Please note that depending on which method you will use, the recipient's and/or the sender's bank may charge a fee for such an operation.

If you have cash, the cheapest way is to top up through the EasyPay terminals, using authorization through Diya, but take into account the limit for such an operation (as of June 2024, up to 250,000 UAH per day).

If the money is in an account of another bank, use the transfer by details (IBAN). You can find account details in the section Cards.

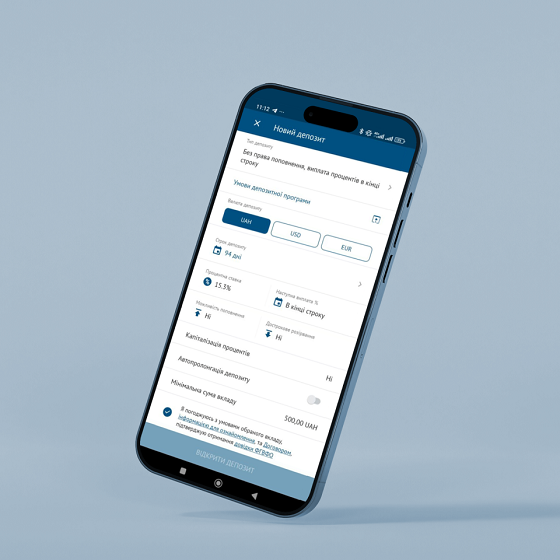

| Method of registration | in a branch of the Bank or in the app MyBank365 |

| Minimum amount | 500 UAH, 500 USD, 500 EUR |

| Maximum amount | without limits |

| Placement period | from 32 to 1098 days |

| Payment of interest | monthly or at the end of the validity period |

| Possibility of early termination | no |

| Possibility of replenishment | at the customer's choice |

| Auto-renew | possible |

| Support services The interest rate depends on the terms of the Agreement, namely: the term of the deposit, the periodicity of interest payments, the possibility of replenishing the deposit and other conditions. | |

By signing the bank deposit agreement (hereinafter - the Agreement), the client confirms that he has familiarized himself with the Terms and Conditions for the provision of banking services, which is a public offer (offer) posted on the Bank's website https://www.clhs.com.ua ( hereinafter – the Public Offer) and familiarized himself with the possible consequences for the client in the event of using the specified banking service or failing to fulfill his obligations in accordance with the Agreement and the Public Offer.

Consequences for the client in the case of using the banking service or failing to fulfill his obligations in accordance with the Public Offer and the Agreement on the provision of this banking service:

- profit received from deposit operations is subject to taxation, according to the current legislation of Ukraine;

- if the depositor receives benefits or subsidies, obtaining additional profits may lead to their loss;

- when transferring funds to a savings (deposit) account opened with the Bank, the Bank, under the terms of the contract, undertakes to return them, and the depositor to pay for the Bank's services.

In case of untimely application of the client to the Bank for the return of funds raised under the bank deposit agreement, the Bank, in accordance with the Public Offer and the Agreement:

- ensures the preservation of the amount of the Deposit and accrued interest in the relevant accounts opened in accordance with the Agreement, until the time of the Depositor's request for return Deposit and accrued interest. At the same time, the Bank charges interest on the actual balance of funds in the Deposit Account, starting from the date of return of the Deposit, established by the Agreement, at the interest rate of the deposit on demand;

- or, if the Agreement provides for an automatic extension, extend the term of the Agreement for the same period for which the deposit was made and on the same terms on which the Agreement was concluded. An exception is the interest rate, which upon automatic extension of the Agreement is changed to the interest rate effective in the Bank on the day of extension of the Agreement for this type of Deposit. Previously accrued interest is not subject to conversion. The number of automatic renewals of the Agreement is unlimited and can be carried out until the account is fully refunded.

The Bank is prohibited from requiring the client to purchase any goods or services from the Bank or a related or related person as a prerequisite for the provision of these services (except for the provision of a package of banking services).

The Bank does not have the right to unilaterally make changes to contracts concluded with clients, unless otherwise established by the Contract, offer or law.

The client has the right to refuse the contract for the provision of banking services, if such a right is provided for by law.

The client has the opportunity to refuse to receive advertising materials through remote communication channels by contacting the Bank's manager or the Bank's Contact Center.